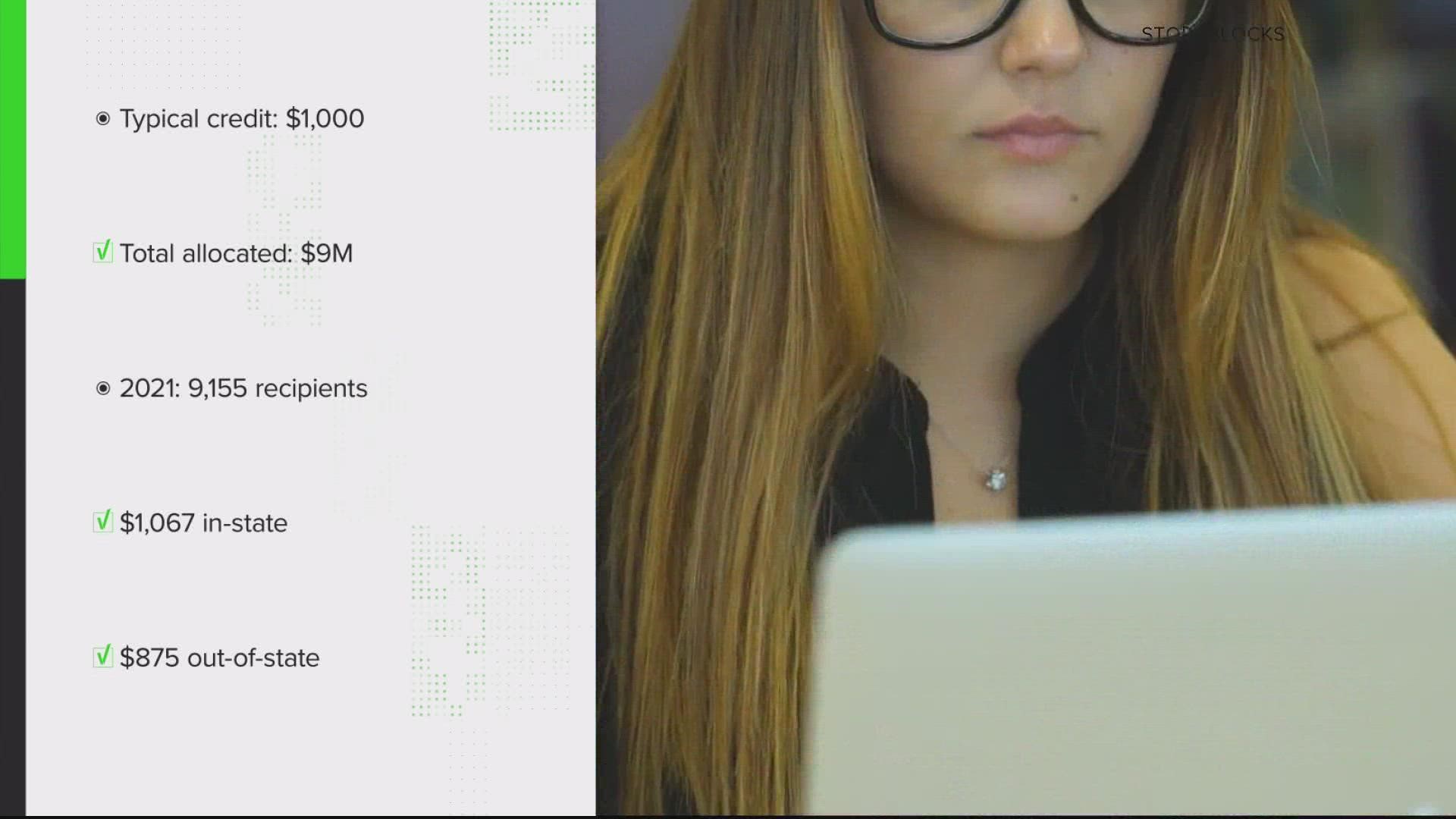

student loan debt relief tax credit for tax year 2021

When setting up your online account do not enter a temporary email address such as a workplace or. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as.

Biden Extends Student Loan Relief Is Loan Forgiveness Next Kiplinger

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

. See my statement on federal student debt relief with. One begins to lose rest and feels pressured. Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form.

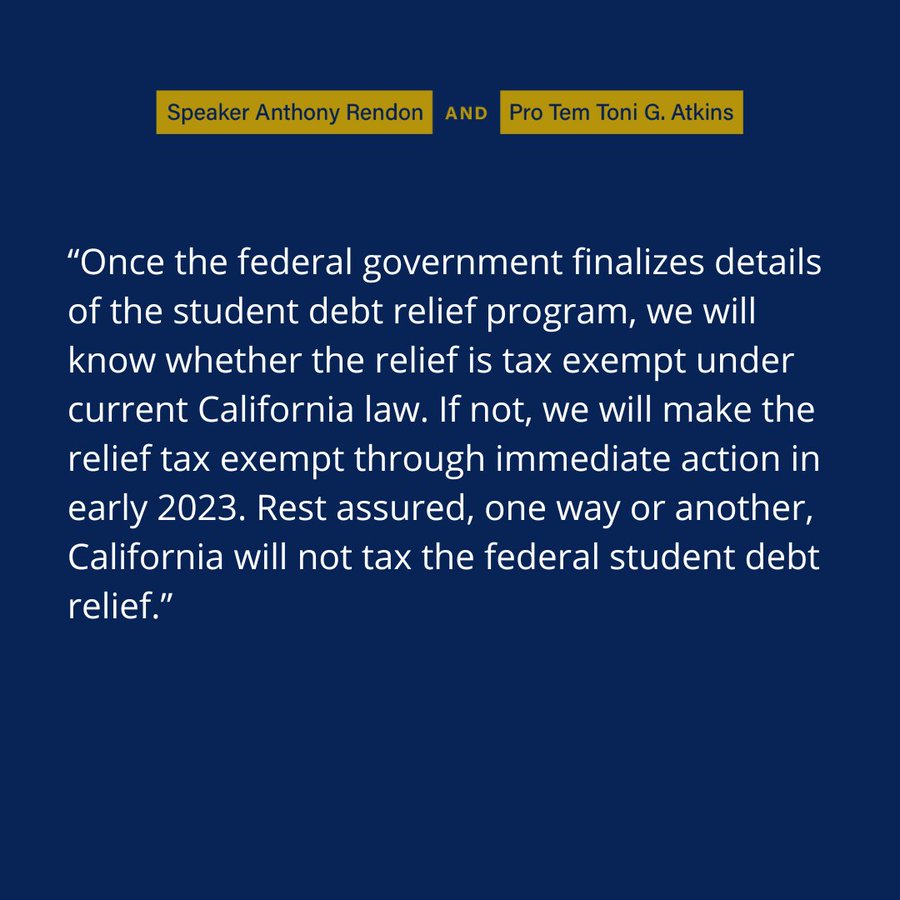

Mississippi has a graduated income tax rate ranging from 3 to 5 and Minnesotas graduated tax rate spans from 535 to 985. 2 days agoNovember 6 2022 1120 AM EST. For tax financial debt relief CuraDebt has an extremely professional group solving tax obligation financial debt concerns such as audit protection complicated resolutions uses in concession.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Eligible Undergraduate andor Graduate Student Loan Balance. F or some borrowers the impact of the White Houses student-debt forgiveness program may be influenced by the interpretation and.

Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application. Mhec student loan debt relief tax credit program for 2021. Have incurred at least 20000 in undergraduate andor graduate student loan.

A copy of your Maryland income tax return for the most recent prior tax year. For Maryland Residents or Part-year Residents Tax Year 2021 Only. Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form.

The latest release by the US. Debts not reported when filing for bankruptcy. A copy of your Maryland income tax return for the most recent prior tax year.

If you receive student loan forgiveness in. There are a few qualifications that must be met in order to be eligible for the 2021 tax credit. 1 day agoThis includes.

For 2021 you were eligible. The Student Loan Debt Relief Tax Credit is a program. The Maryland Higher Education Commissionmay request.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. If you made payments on your federal student loans during this time the government will refund what you paid and cancel your loan up to the maximum debt relief.

Child support and alimony payments. Certain tax claims and unpaid federal income tax. It was founded in 2000 and is a.

Debts for willful and. Complete the Student Loan Debt Relief Tax Credit application. Tax obligation financial debts could be a result of errors from a previous tax obligation preparer under withholding failing to send payroll tax withholdings to the internal revenue service.

The latest Education loan Debt settlement Taxation Credit was a program created significantly less than 10-740 of your Taxation-General Blog post of your Annotated Password out-of. About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021. Bureau of Labor Statistics unveiled a 04 percent increase in the Consumer Price Index for All Urban Consumers CPI-U during September - up.

Amounts canceled as gifts bequests devises. Four states plan to tax forgiven student loans as income while two hang in the balance.

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

Maryland Higher Education Tax Credit Deadline Is September 15th Bradyrenner Cpas

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Understanding The Tax Implications Of Student Debt Forgiveness Urban Institute

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Will Student Loan Repayment At Long Last Be A Game Changer

Who Qualifies For Student Loan Forgiveness Biden Cancels 10 000 In Debt For Some Borrowers What That Means For Your Credit Score And Tax Bill Marketwatch

Some States Could Tax Biden S Student Loan Debt Relief Boston News Weather Sports Whdh 7news

Can I Get A Student Loan Tax Deduction The Turbotax Blog

After President Biden Cancels Student Debt Center For American Progress

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

/cdn.vox-cdn.com/uploads/chorus_asset/file/23983301/1417997644.jpg)

Is Student Loan Forgiveness Fair The Debate Explained Vox

Biden S Student Loan Forgiveness Policy How To Apply Who Qualifies More Abc News

Student Loan Forgiveness Government Offers Updates On Eligibility

Comptroller Implores Marylanders To Apply For Student Loan Tax Credit Afro American Newspapers

Student Loan Debt Relief Remains On Hold But Could Forgiveness Wipe Out Your Tax Refund Cnet

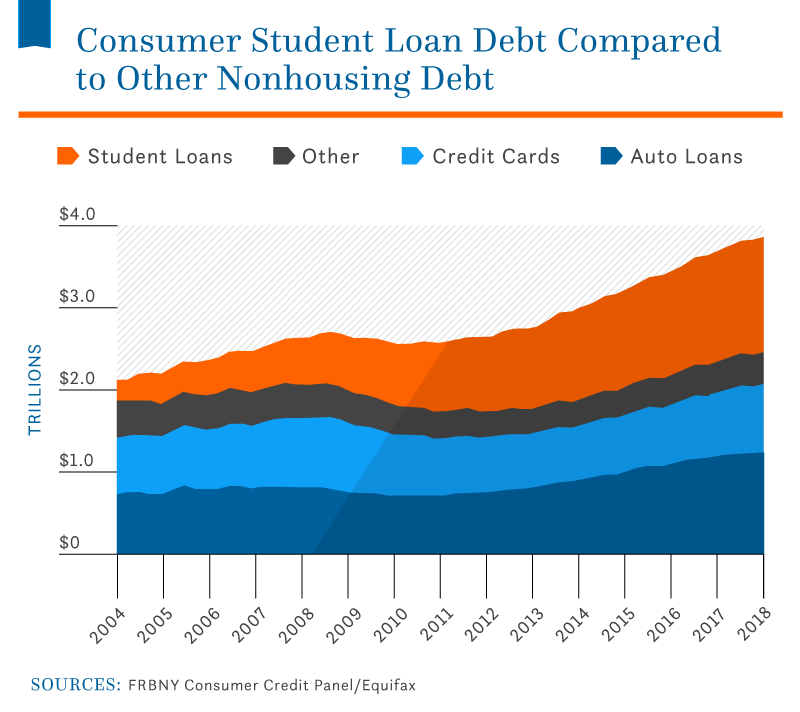

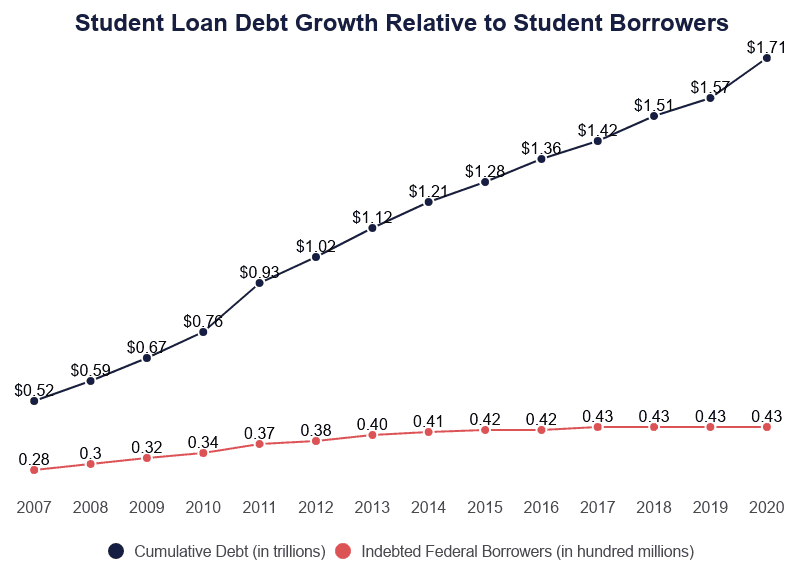

Student Loan Debt Crisis In America By The Numbers Educationdata Org

Price Tag Of Biden S Student Debt Relief Is About 400b Cbo Says Politico